Is Your Business on Track?

It’s time for you determine if you’re on track to your plan – the budget vs actual report.

What is the Budget Vs Actual Report?

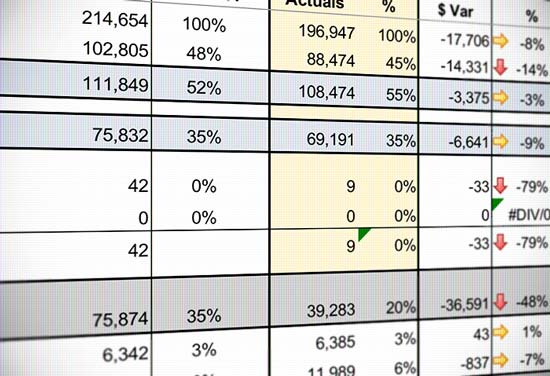

Simply put, this report is a comparison between your anticipated (or budgeted) expenses and income and the reality of what actually occurred. This one report can quickly show you if you are on track with regard to income and expenses. Think of it as a progress report for your business!

What is included in the report?

The budget vs actual report is run based on your P&L (profit and loss statement), so the fields and data in the budget vs actual will depend on your P&L line items. You’ll be able to measure top-line sales data, and line-by-line expense data.

When should you run the Budget vs. Actual Report?

If your budget is broken down by month (and most businesses are set up this way), you should run the report monthly, after all month-end data has been captured.

Why should you use a budget vs. actual report?

The budget vs actual report is a critical tool for business owners. Many of the other financial reports provide data that is important, but no other report is tied to your goals like the budget vs actual report.

You’ve probably heard the term, “What gets measured gets managed”. This is true in your business as well, and it’s one of the reasons the budget vs actual report is so critical to your success. It is used as a tool to help you measure against a plan and then manage your actions accordingly.

Observing income and expenses only without comparing it to something is a bit like wanting to lose weight without having a goal weight or size in mind. Simply stepping on the scale every week and noting your weight isn’t particularly meaningful if you don’t know whether you have made progress toward an end goal.

Budget vs actual reports are a great resource to help you:

Determine if you are over- or under-spending

Identify specific areas your business is getting out of control

Be intentional in your spending so you can achieve your objectives and initiatives

Leveraging your budget vs. actual

If you have goals for your business, you should be using your budget vs actual report to help manage your progress. Just five minutes each month with this report will quickly show you if you are on target, where you need to make course corrections, and can significantly boost your chances of hitting those goals.

One of the important things to identify in your report are “outliers” – irregularities in the planned operations of your business. Some of these may be intentional; others may not. Any item that is 10% or more above or below projections should be considered an outlier. Note: this can be subjective to an individual account or business. It may be more meaningful to allocate an amount instead of a percentage.

It’s entirely possible that outliers can be positive in nature. For example, income may be 12% above what you projected. That’s a great thing! And it would be helpful to spend a few moments understanding why that income figure was high so you can duplicate those results.

On the flip side, if you are an office supply junkie you may find that your line item for office supplies is consistently over budget. Once you’ve figured that out, you can address habits that may be contributing to the problem.

Of course, there will always be variances. It would be very rare for a business to exactly match budget vs actual numbers! However, the key in leveraging the report is in being able to explore questions, discover answers, and fine-tune your business operations.

Consistently leveraging your budget vs actual report can help your business project, plan, prepare, and prosper!

Are you operating your business without a budget? You’d be surprised to hear how many business owners are in the same boat! The thought of creating a budget can be paralyzing, especially when you haven’t done it before.

Comments